In the city of state-of-the-art architecture, the latest technologies, luxury, and countless entertainment outlets, you always want to explore and live more amazing experiences. But this dream doesn’t come without its expenses, that’s why we’re seeing more Dubai, UAE residents creating their own small projects to earn extra cash.

Setting up a business in Dubai, UAE poses a great advantage whatever your work avenue is.

Situated at the crossroads of Europe, Asia, and Africa, Dubai, UAE serves as a global hub for trade and business, offering easy access to diverse markets.

The UAE, including Dubai, boasts a business-friendly ecosystem with minimal bureaucracy, tax benefits, and various incentives to encourage entrepreneurship and investment.

The city’s diverse population and cosmopolitan culture create a rich market with varied preferences, allowing for niche business opportunities and catering to different consumer needs.

The city’s booming tourism industry and its status as a global trade center present ample opportunities for small projects, especially in hospitality, retail, and services catering to tourists and businesses. Besides, Dubai, UAE offers a high standard of living, safety, and a cosmopolitan lifestyle.

These factors collectively make Dubai, UAE an appealing destination for small projects, offering a conducive environment, support systems, and access to resources necessary for entrepreneurial success.

7 business ideas to earn extra cash in Dubai, UAE

- Online Tutoring

Online tutoring in Dubai, UAE can be a lucrative project, due to the high demand for quality tutoring services, especially for subjects like mathematics, science, languages, and standardized test preparations. This kind of service involves understanding the educational needs and tailoring services to meet them. You can leverage the technological tools and devices effectively to optimize your services. Adapting to diverse curricula is key as well as navigating regulations related to education services.

- Language or Cultural Training

Offering language or cultural training in Dubai, UAE can be a rewarding business venture. Dubai, UAE hosts a diverse population from various nationalities, creating a high demand for language and cultural training services to foster effective communication and understanding among different communities. Language training complements the educational system, offering additional support to students studying Arabic, English, or other languages as part of their academic curriculum. Companies in Dubai, UAE often seek language and cultural training for their employees to improve cross-cultural communication and cooperation within multinational teams.

- Pet Services

Dubai, UAE has a growing pet-friendly culture with a substantial population of pet owners who prioritize the well-being of their furry companions. Dubai, UAE boasts a population with high income, willing to invest in premium pet care services and products for their pets.

When establishing a pet services business in Dubai, UAE, it’s essential to offer a range of services catering to different pet needs. This might include dog walking, pet sitting, grooming, veterinary care, and pet training services. Ensuring high standards of care, using quality products, and employing trained professionals can help differentiate your business.

- Blogging

Starting a blogging business in Dubai, UAE can be a promising venture. Dubai, UAE’s diverse culture provides a wealth of topics to explore and write about. From travel, food, fashion, lifestyle, business, and technology, to local events and experiences. Dubai, UAE is a hub for business and entrepreneurship, offering ample opportunities to write about startups, industries, investment, and economic trends. The city’s status as a tourist hotspot allows for travel-focused blogs that cover attractions, accommodations, dining, and unique experiences. Dubai, UAE is known for its luxury lifestyle and high-end experiences, providing content opportunities for luxury fashion, fine dining, real estate, and exclusive events. You can also create blogs about local culture, traditions, and customs.

- Virtual assistance

Dubai, UAE has a thriving startup ecosystem, and a significant number of entrepreneurs and small businesses seeking cost-effective solutions for administrative tasks, which makes a virtual assistance business in Dubai, UAE a highly viable venture. When establishing a virtual assistance business in Dubai, UAE, it’s crucial to determine the specific services you’ll offer, such as administrative support, customer service, social media management, bookkeeping, or specialized industry-specific assistance.

Create a professional website showcasing your services, skills, and testimonials, and leverage social media and online platforms to reach potential clients. Attend industry events, join business networking groups, and ensure high-quality service delivery and efficient communication to build trust and retain clients.

- Freelance Writing or Translation Services

Dubai, UAE’s diverse population and multinational business landscape create a demand for content and communication services in multiple languages. The expatriate population in Dubai, UAE often seeks translation services for legal documents, business communication, or personal needs, creating a niche market for language services. Utilize your language skills to offer freelance writing, content creation, or translation services to businesses seeking diverse language support.

- Personal training

Dubai, UAE has a luxury fitness market that caters to affluent clients seeking exclusive and personalized fitness services, creating opportunities for high-end personal training. To establish a successful personal training business in Dubai, UAE, you need to identify your target market and obtain relevant certifications and qualifications in personal training to build credibility and trust. Develop a strong brand identity and market your services through social media, fitness events, local communities, and online platforms to attract potential clients. you can also collaborate with gyms, health clubs, wellness centers, or corporate wellness programs to expand your client base and reach a wider audience.

Remember, setting up a business in Dubai, UAE involves specific procedures and legalities. It’s crucial to research thoroughly and seek guidance from experienced business setup professionals in the UAE, like SPC Free Zone, to ensure compliance and the successful establishment of your venture.

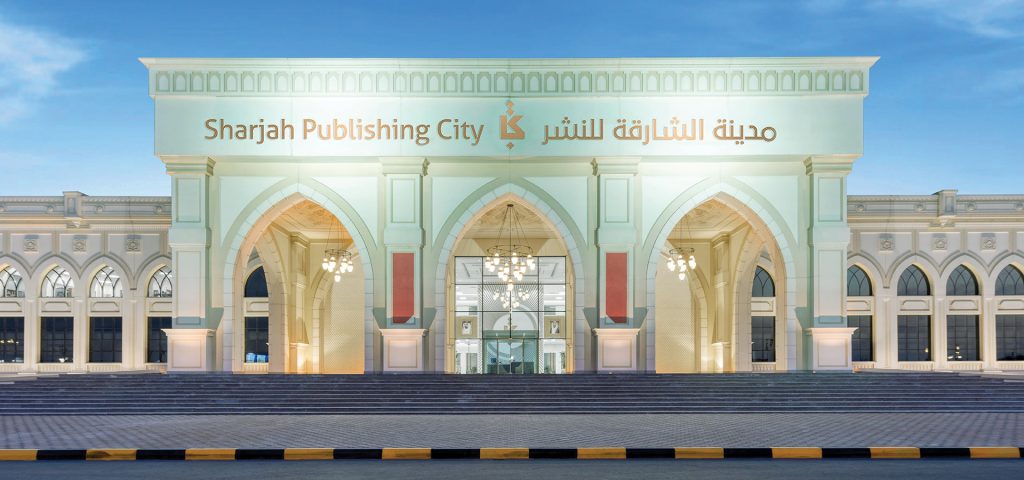

Why choose SPC Free Zone?

Conveniently located in the heart of Sharjah, SPC Free Zone offers a fast and flexible business setup in the UAE. You can receive your e-commerce license in UAE in just two hours and benefit from immigration services onsite, too. We offer a wide range of competitive packages with a choice of over 2000 business activities, up to 20 visas under one trade license, and a dual license option that offers both mainland and free zone on the same license. Entrepreneurs can also maximize their profits with 100% foreign ownership and zero-paid-up capital.

Ready to start your online business in the UAE? Get in touch with our friendly advisors for help with business setup in the UAE today.